Disruption to global trade and strikes against Yemeni cities; the Israel-Hamas conflict has become a global phenomenon through the actions of the Houthi Rebel group in Yemen.

The Houthis have repeatedly targeted ships using the RedSea route, in attacks in support of Palestinian civilians in Gaza. The Houthis will show no deterrence unless humanitarian aid is allowed in Gaza.

This is a Shiite armed group that has struggled for power for many years against other Yemeni factions backed by KSA and the UAE. After the US invasion of Iraq in 2003, the Houthis aligned themselves against Israel and its Western allies and became a proxy for Iranian forces. Over the years they have acquired significant strike capabilities, attacking several Saudi assets before the Yemen peace process gained momentum in 2020.

The recent attacks endanger the transit route through which up to 12% of world trade goods are transported. In December, the United States set up a multinational naval force to protect ships in the Red Sea. Supported by Iran, the Houthis have warned that they will target any ship with links to Israel, in response to the bombing of Gaza.

The US and UK have stepped up attacks on Houthi targets in Yemen, once again raising the spectre of a full-blown conflict in the region. How the conflict pans out will depend on many variables and will be decided equally in Saudi and Egyptian capitals and Yemeni internal dynamics – but for now, the companies will have to map impact and prepare for contingencies.

Implications:

The Red Sea carries around 10% of global demand for oil shipments. In response to the attacks, four of the largest shipping companies announced that they would suspend all transit via the Bab Al-Mandab Strait.

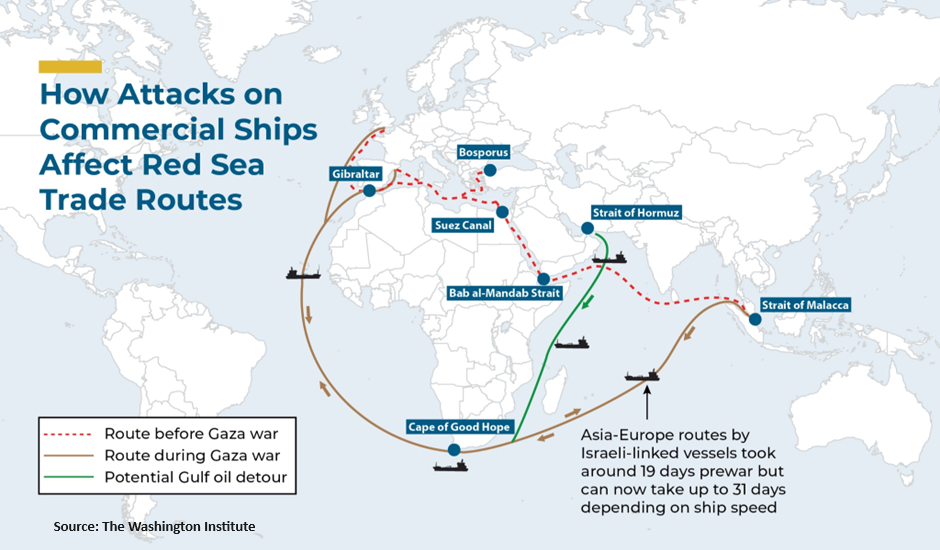

The attacks have rerouted most of global trade away from the major maritime route. Ships diverted from the Suez Canal will be forced to go around the Cape of Good Hope, much like trade did before the Suez Canal existed.

On average, the transit trade volume in the Bab el-Mandeb Strait has dropped 44% between the beginning of December and beginning of January. The average between mid-December to mid-January is also 39% below last year’s numbers.

Last month, 50% of container ships that routinely transit the Suez Canal and pass through the Red Sea avoided the waterway due to the escalating number of attacks.

This longer journey increases fuel costs, reduces shipping efficiencies, and has raised insurance rates due to the risks of war. A 7-day shipment through the Red Sea costs about 0.6% of the value of the cargo and the cost has now reached 2%. The charges for transporting a container from China to Europe increased up to 248% since the week before the first attacks.

The Israeli port of Eilat has seen deliveries decrease by 85%. Important Chinese shipments to Israel have ceased, on which Israeli port of Haifa highly depends. This shows the impact of the Houthis’ “poor man’s sanction” against Israel.